- Published: 12 October 2010

- ISBN: 9780141043159

- Imprint: Penguin General UK

- Format: Paperback

- Pages: 304

- RRP: $32.00

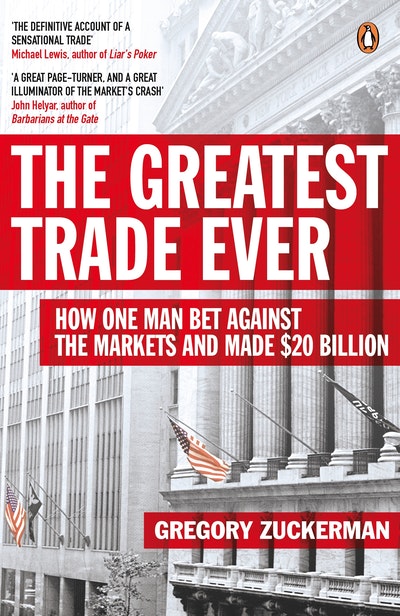

The Greatest Trade Ever

How John Paulson Bet Against the Markets and Made $20 Billion

- Published: 12 October 2010

- ISBN: 9780141043159

- Imprint: Penguin General UK

- Format: Paperback

- Pages: 304

- RRP: $32.00

A magnificent insider look at how Paulson and others profited off of subprime's demise... insightful and gripping.

Marketfolly.com

Much, much more than a brilliant account of Paulson's trade of the century; this book also provides a highly enjoyable and lucid journey through the analytical and emotional maze that constituted the financial markets on the eve of the Great Recession. Compulsory reading.

Mohamed El-Erian, CEO of Pacific Investment Management Co and author of When Markets Collide

Zuckerman takes us to Wall Street's heart of darkness, where mushroomed a $1 trillion subprime mortgage market that only the few, the brave, the smart dared short. This is at once a great page-turner and a great illuminator of the market's crash.

John Heylar, co-author of Barbarians at the Gate

Compelling

Economist

Extraordinary, excellent

Observer

A forensic, read-in-one-sitting book

Sunday Times

A must-read for anyone fascinated by financial madness

Mail on Sunday

Greg Zuckerman was the first to tell the world about John Paulson's sensational trade . . . He's written the definitive account of a strange and wonderful subplot of the financial crisis

Michael Lewis, author of Liar's Poker

Simply terrific. Easily the best of the post-crash financial books

Malcolm Gladwell